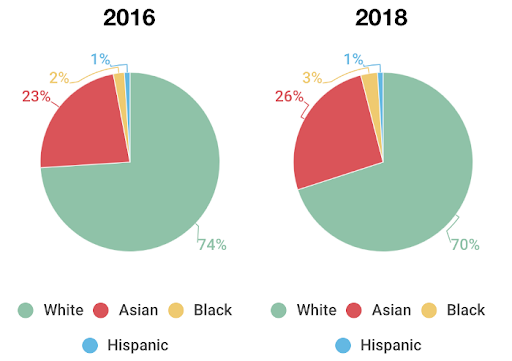

For years, the gender, racial, and ethnic disparities in venture capital industries have been striking. Noteworthy estimates that 70% of venture capital investors in 2018 were white, a mere decrease from 74% in 2016. The gender gap is even stronger, with only 18% of investors being women.

While the data may show a slight improvement in recent years, it does not detract from the fact that venture capital has historically been one of the most homogeneous industries. This industry-wide lack of diversity negatively impacts success, but overcoming this barrier requires understanding the factors that have enabled this inequity to persist.

Although representation of women and nonwhite people has been growing in other areas, venture capital firms have noticeably lagged behind. To understand this, one must first examine the nature of the industry, and how this business model perpetuates inequality.

Venture capital leadership is generally a small team of fewer than 10 investors, and vacant spots are a rarity. And because of the small size, when positions are available, investors tend to choose applicants with whom they share various identities.

Harvard Business Review suggests that this results in a cycle where current venture capitalists primarily take on new partners who look like them, went to the same school as them, or are from the same socioeconomic status as them. As the cycle repeats itself, the homogeneity becomes even deeper entrenched in the system, and stopping it becomes an even bigger obstacle.

Studies suggest that this lack of diversity adversely impacts the success of the businesses these firms choose to invest in. As the investors help clients shape policies and strategies, the unilateral way of thinking and absence of diverse perspectives hurt innovation, and prevent new opportunities and partnerships from coming to fruition.

For early-stage startups, it’s crucial to make diversity a priority early on. Often times, new entrepreneurs don’t see cultivating a diverse team as an initial concern, instead deeming it something to be addressed later, after the firm grows. However, incorporating diversity into the company’s mantra right off the bat reaps many benefits.

McKinsey profiled the profitability of various firms, and found that firms with greater diversity in their management teams achieved greater profit margins and witnessed more tangible success.

It’s much easier to build a diverse and inclusive team from the ground up than to try to diversify a system once it’s already been established, which presents a strong case for cultivating a diverse team for an early-stage organization.

Recognizing this untapped potential, many organizations are developing concrete programs to recruit more diversity in venture capital. In an interview with Marketplace, venture capital partner Ilya Fushman shares that at his firm, Kleiner Perkins, they have been able to increase the presence of historically underrepresented groups through fellowship programs that connect existing partners to younger talent. Currently, 50% of program participants are women, and they are hopeful that their percent of Black and Hispanic participants (currently 7% and 4%, respectively) will increase similarly.

Other fellowship programs such as the Kauffman Fellowship program have been successful in bringing much-needed diversity to the forefront of various venture capital firms. Following the appointment of Marlon Nichols, the board is now 25% black and 38% female, according to TechCrunch. Nichols’ journey from program participant to organization director is an inspiring one, and his success can serve as an inspiration to other young entrepreneurs.

Ultimately, fostering diversity in the context of venture capital depends on organizations prioritizing diversity early on in their careers, and delivering on this process by developing new talent and enabling them to succeed. As a diverse firm that mainly deals with other small businesses and early-stage startups, the Cre8tive Capital team brings experience, expertise, and excitement to helping its clients maximize their potential. We also particularly recognize the hardships posed by COVID-19, which is why we launched our FREE 30-minute business consultations for entrepreneurs feeling challenged by recent events. Visit our COVID-19 office hour page for more information!